Tax professionals are being increasingly targeted by identity and data thieves. An unscrupulous person breaching the data of one tax return preparer can gain hundreds or thousands of taxpayers’ data. One way you can monitor for suspicious activity is to regularly check how many federal tax returns have been filed with your Preparer Tax Identification Number (PTIN).

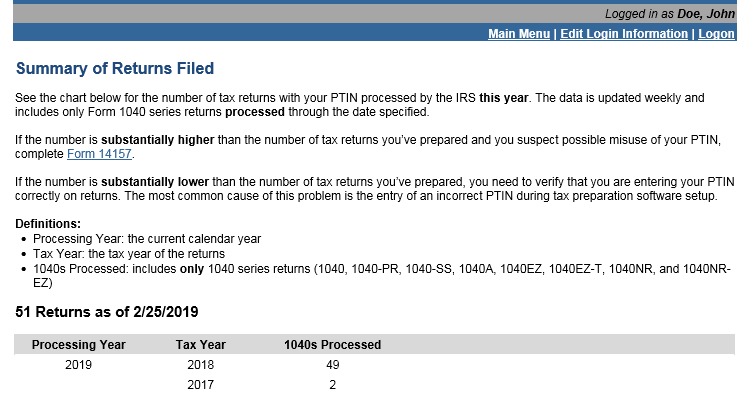

This information is available in the online PTIN system for tax return preparers who have at least fifty Form 1040 series tax returns processed in the current year.

It is important to monitor this information even if you do not prepare returns or only prepare a small number of returns.

To access PTIN information, follow these steps:

- Visit ww.irs.gov/ptin and log into the PTIN System.

- From the Main Menu, under “Additional Activities”, select “View My Summary of Returns Filed”.

- A count of individual income tax returns filed and processed in the current year will be displayed. The information is updated weekly.

If the number of returns processed is significantly more than the number of tax returns you’ve prepared and you suspect possible misuse of your PTIN, complete and submit Form 14157, Complaint: Tax Return Preparer, to the IRS.